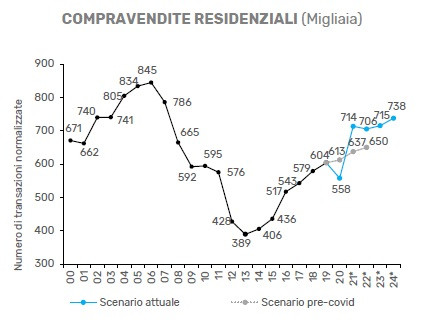

Nomisma, a Bologna-based strategic and business consulting firm, outlines a rosy future for the Italian real estate market. The data announced by Nomisma's chief economist, Lucio Poma, speak of significant growth favored by the substantial resources linked to the National Recovery and Resilience Plan (PNRR). If in the second quarter of this year a modest +0.2% was recorded, forecasts for the next two periods indicate a +2.7% and +2.6% respectively, to close 2021 with an overall +6.1%. These numbers are also the result of inflation that in our country stands at 2.9%, compared to 4% in the euro area and 6% in the United States. Luca Dondi, CEO of Nomisma, points out that in 2021 more than 3.3 million families have undertaken the search for a new home. This figure stems in part from the growing interest in buying by the 18-34 year olds and in part from the needs of the pandemic, such as the search for livable outdoor spaces. In this scenario, the change of the current first home weighs in at around 80%, while the investment component stands at 10%, rising to 15% in large cities. There is also a phenomenon of de-urbanization, as more and more people are inclined to buy a house in the suburbs, able to offer more outdoor space and a context more in contact with nature. In the two-year period 2019-2021, the number of purchases and sales grew by 23.6%. According to Nomisma, this trend will lead in 2024 the number of purchases and sales to stand at 738 thousand units compared to 558 thousand in 2021, supported by larger discounts (12.2%) and reduced sales time (5.5 months). On an annual basis, the average change in house prices is equal to +1.6% with positive peaks found in Milan (+4.1%) and negative ones in Palermo (-1.2%). This analysis could not fail to take into account mortgage disbursements, which at the end of the year are expected to reach 60.8 billion euros. The driving factor in this case is linked to the still very low interest rates. It should be noted that the increase in average gross income corresponds to a growth in demand for mortgages, which reached 52.5% in the last year compared to 51.7% recorded in 2019.